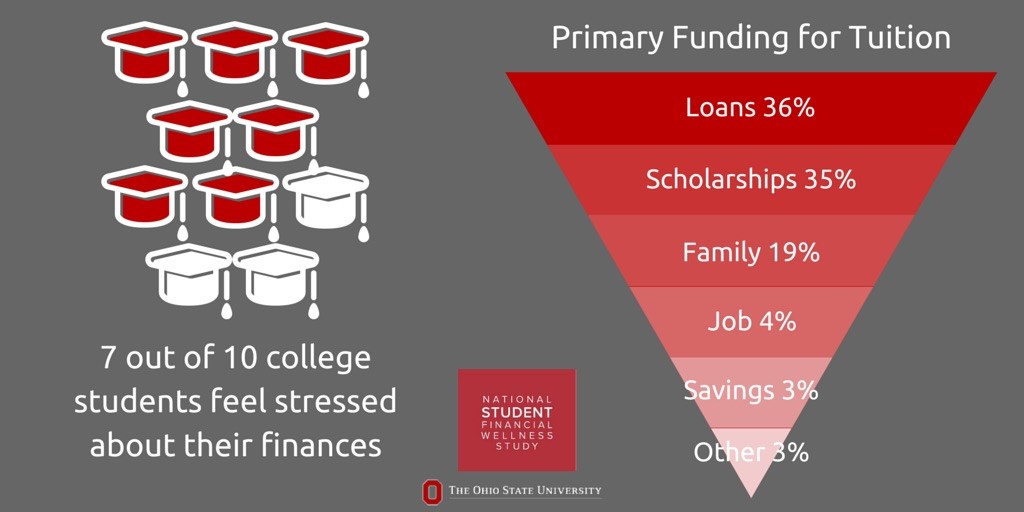

Photo from The Ohio State University, National Student Financial Wellness Study.

By Noelle Belanger

Students all around the nation stress their entire time in high school about whether they are going to college or if they are going to be able to afford it. During an interview with Jen Daley, a College Counselor at Sedro Woolley High School we went over if whether or not college tuition costs and gone up or down, during the past year. After being hit with a pandemic and suffering financially we examined if colleges and universities are recognizing this and adjusting to help more people be able to attend.

During the interview with Jen Daley, many questions were picked apart to get to the root of this question of whether or not these prices are changing or not.

When discussing whether college tuition changed during the pandemic or not, the answer is no.

Daley says that, “In 10 states, average tuition and fees at four-year, in-state public schools did not increase at all the school year. Covid-19 has definitely had an impact on higher education, but although average tuition still increased again this year, the increases are among the lowest we’ve seen since 1990-91, so that is something positive”.

Although they aren’t seeing as much of a rise in costs, there is not a decrease either. This raises the question, “Is more money in scholarships being handed out this past year?”

Daley says that she has not yet seen more scholarships, however she is seeing an increase in the promotion of them. “I think both were afraid that they wouldn’t get any applicants. I believe that if this were to go on another full year that colleges will see a more significant drop in enrollment, but this school year there has been enough unknowns and efforts to mitigate it through online learning that the effect was not so pronounced as expected.” This is a good sign even though there aren’t more being offered it is being more encouraged.

Daley explained that when it comes to grace periods with colleges and universities, they are willing to work with students. She continued on to say, “Colleges are typically willing to work with students and their families to provide payment plans over the semester/quarter to pay tuition and fees. Housing must be paid up front. Every school is different and some take it on a case-by-case basis depending on your circumstance, hardship, etc.”.

Daley discussed how colleges are dealing with loan rates during this time too. She explained that they lowered the loan rates and she believes the will keep it this way, until the pandemic is still going on and until, they get things under control. She said, “The federal government has been waiving student loan interest since March 2020”.

Still today many people don’t understand why college is so unbelievably expensive. Even when people receive grants and scholarships it calls for deep pockets or leaves people with student debt for many years to come when they are out of school. More people are seeking out higher education and colleges are expanding what they offer in terms of degrees, more entry-level jobs now require an undergraduate degree, and campus student services, faculty, technology, dorms. Private schools also can take advantage of the student loan system due to the fact that people can take out up to 100,000-dollar loans for school so they can set their tuition and total costs to the maximum.

Schools are getting subsidized. Public schools are subsidized by state governments which enables them to charge lower tuition rates to students. Daley said that, “Both public and private colleges can provide federal financial aid to students. This difference lies in that private institutions typically have more money available to fund institutional grants and scholarships and public universities, which tend to be larger in size, are better able to offer work-study positions to a greater number of students”.

According to an article published by Inside Higher Education, community colleges saw their lowest enrollment decline this past fall. There was a 2.5 decline in enrollment this past fall. This is twice as much as reported in 2019. Daley confirmed this statement and talked about how there was around 400,000 less students enrolling this past fall.

Even though costs didn’t decrease they did see a lower increase. Typically, there would be an incline of costs but this past year school costs haven’t gone up as much as it would have.

Today if you were looking to enroll in a further education, whether that be community college or a university the best way according to Daley would be to fill out your FAFSA and see what you qualify for in terms of state and federal grants and loans. Working hard during your high school is very important too. Appling for running start is very wise to further your education.

According to a Forbes article published last year by Robert Farrington, the best five ways to afford college are applying for scholarships and grants, choosing a career in public service, look into work-study programs, attended a community college first and pursue a trade rather than a four-year degree.

Unfortunately for many there is no tuition change, but there are ways to help out these students searching for an education outside of high school, and there are many willing people looking to help.